04 March, 2025

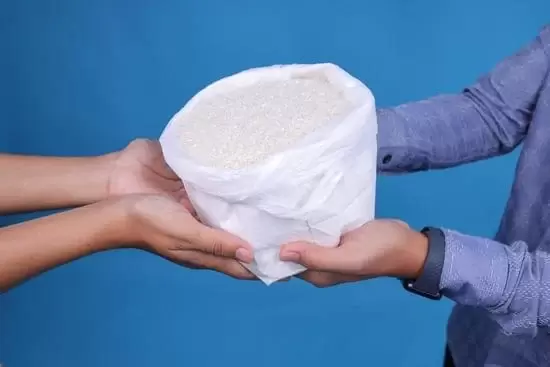

Zakat is one of the Five Pillars of Islam and an essential act of worship for Muslims. It is a mandatory charitable contribution aimed at purifying wealth and helping those in need. The word "Zakat" in Arabic means "purification" and "growth," symbolizing how giving in charity cleanses one's earnings and promotes social welfare.

Every eligible Muslim must give a portion of their wealth annually to those who qualify to receive it. This obligation fosters a sense of responsibility, generosity, and solidarity within the Muslim community.

Zakat is more than just a financial duty; it has profound social, economic, and spiritual benefits.

1. Helping the Poor and Needy

-

Zakat provides financial support to those who struggle to meet their basic needs.

-

It alleviates poverty and ensures that wealth is distributed fairly within society.

2. Promoting Social Justice and Economic Balance

-

Zakat prevents wealth from being concentrated in the hands of a few.

-

It bridges the gap between the rich and the poor, fostering economic equality.

3. Purifying Wealth and Soul

-

It cleanses one’s earnings from greed and selfishness.

-

It encourages gratitude and reliance on Allah.

4. Strengthening Community Bonds

-

It creates a culture of generosity and mutual aid.

-

It builds trust and social cohesion among Muslims.

To fulfill the obligation of zakat, Muslims must first determine whether their wealth meets the nisab (minimum threshold) and then calculate the required amount.

1. Understanding Nisab

-

Nisab is the minimum amount of wealth a Muslim must have before being obligated to pay zakat.

-

It is equivalent to 85 grams of gold or 595 grams of silver.

2. The Standard Zakat Rate

-

The general zakat rate is 2.5% of one’s savings and wealth that has been held for a lunar year.

3. Zakat Calculation Examples

-

On Money: If a person has $10,000 in savings for a year and the nisab is $5,000, they must pay 2.5% of $10,000, which equals $250.

-

On Gold & Silver: If someone owns 100 grams of gold, they must pay zakat on 85 grams or more.

-

On Business Income: Zakat is calculated on business profits after deducting necessary expenses.

Read More:

Who is eligible to pay zakat?

Zakat is obligatory for every Muslim who:

-

Possesses wealth above the nisab threshold.

-

Has held the wealth for a full lunar year.

-

Is of sound mind and has reached puberty.

Who can receive zakat?

Zakat is distributed among eight categories of people mentioned in the Quran (9:60), including:

-

The poor and needy.

-

Those in debt.

-

Travelers in difficulty.

-

New Muslims or those whose hearts need to be reconciled.

What happens if someone doesn’t pay zakat?

-

Neglecting zakat is a serious sin in Islam.

-

It can lead to spiritual consequences and accountability on the Day of Judgment.

-

Some scholars believe that withholding zakat can lead to financial hardships and loss of blessings.